Introduction: Traveling the world is a dream for many, but managing your finances while exploring new destinations can be a daunting task. That’s where Traveloof Travel Finance comes to the rescue! In this blog post, we’ll explore essential financial tips and tools to help you make the most of your travel budget and ensure a stress-free and enjoyable journey.

1. Create a Travel Budget:

Before you set off on your adventure, it’s crucial to create a detailed travel budget. Determine how much you can afford to spend on your trip, including expenses such as flights, accommodations, food, activities, and incidentals. Traveloof’s budgeting tools can assist you in organizing your finances effectively.

2. Save and Plan Ahead:

Start saving for your trip well in advance. Open a dedicated savings account or use a Traveloof budgeting app to set aside funds regularly. Planning ahead allows you to avoid last-minute financial stress and ensures you have enough money to fully enjoy your journey.

3. Choose the Right Payment Methods:

Decide which payment methods are best suited for your travels. Traveloof offers a range of payment options, including travel debit and credit cards, which often come with travel rewards and reduced foreign transaction fees. Ensure your chosen payment methods are widely accepted at your destination.

4. Notify Your Bank and Credit Card Companies:

Before you depart, inform your bank and credit card companies of your travel plans, including your destination and travel dates. This prevents your cards from being blocked due to suspicious activity when used abroad.

5. Monitor Exchange Rates:

Stay informed about exchange rates to get the most value for your money. Traveloof’s currency conversion tools and real-time exchange rate information can help you make informed financial decisions.

6. Use Traveloof Rewards and Loyalty Programs:

Take advantage of Traveloof’s rewards and loyalty programs to earn points and discounts on flights, accommodations, and activities. These programs can significantly reduce your travel expenses.

7. Track Your Expenses:

Keep a record of your daily expenses while traveling. Traveloof’s expense tracking apps can help you stay organized and ensure you don’t overspend.

8. Set a Daily Spending Limit:

To avoid blowing your budget, set a daily spending limit and stick to it. Traveloof’s spending tracker can help you stay on top of your daily expenses and adjust your spending accordingly.

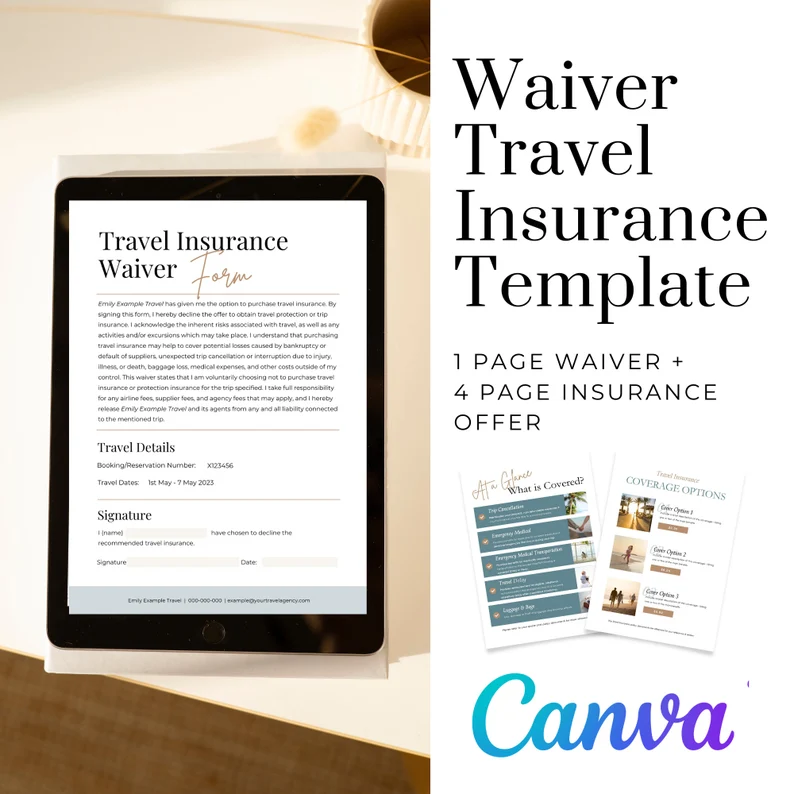

9. Have Emergency Funds:

Always have access to emergency funds in case of unexpected situations. Traveloof’s travel insurance includes coverage for emergencies such as trip cancellations, medical issues, or lost luggage.

10. Be Cautious with ATMs:

When withdrawing cash from ATMs, choose reputable and well-lit machines, and be mindful of ATM fees. Traveloof’s ATMs locator can help you find secure and convenient ATMs at your destination.

Conclusion:

Traveloof Travel Finance is your partner in managing your finances efficiently while traveling the world. By implementing these financial tips and utilizing Traveloof’s financial tools and resources, you can make the most of your travel budget and focus on creating unforgettable memories. With smart money management, you can explore new horizons without financial worries. Safe travels and happy budgeting!