Unlocking Wealth: The Power of Property Investment

Introduction

Property investment has long been regarded as one of the most reliable and lucrative ways to grow wealth. Whether it’s residential, commercial, or industrial properties, investing in real estate offers a unique set of advantages and opportunities. In this blog post, we delve into the world of property investment, exploring its benefits, strategies, and the keys to success in this dynamic market.

1. The Appeal of Property Investment

Property investment appeals to individuals and organizations alike due to its potential for long-term capital appreciation, passive income generation, and portfolio diversification. Real estate is a tangible asset that often withstands market volatility.

2. Types of Property Investment

Property investment encompasses various types of properties:

- Residential: Investing in homes, apartments, and condominiums for rental income or capital appreciation.

- Commercial: Acquiring office spaces, retail centers, and industrial properties to lease to businesses.

- Industrial: Investing in warehouses, manufacturing facilities, and logistics centers.

- Real Estate Investment Trusts (REITs): Investing in publicly traded REITs that offer exposure to real estate assets without direct ownership.

3. Benefits of Property Investment

- Steady Income: Rental properties can provide a consistent stream of passive income.

- Appreciation: Real estate values tend to appreciate over time, potentially leading to significant capital gains.

- Tax Benefits: Property investors can benefit from tax deductions, depreciation, and other incentives.

- Diversification: Real estate offers diversification from traditional investments like stocks and bonds.

4. Key Strategies in Property Investment

Successful property investment requires careful planning and execution. Key strategies include:

- Location Analysis: Choosing properties in desirable locations with strong growth potential.

- Market Research: Studying local real estate trends, vacancy rates, and rental demand.

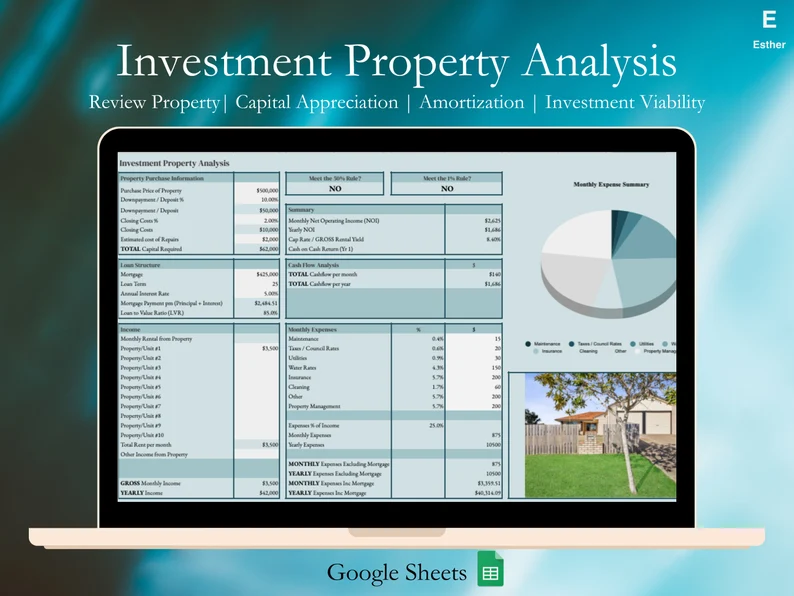

- Financial Analysis: Evaluating the financial feasibility of the investment, including costs, rental income, and potential ROI.

- Property Management: Ensuring effective property management to maintain and enhance property value.

- Risk Mitigation: Implementing strategies to mitigate risks, such as market fluctuations and property vacancies.

5. Challenges in Property Investment

Property investment is not without challenges, including property maintenance, tenant management, market volatility, and financing. Successful investors navigate these challenges through careful planning and risk management.

6. The Impact of Technology

Technology is transforming property investment, with online platforms, real estate crowdfunding, and property management software streamlining processes and increasing accessibility for investors.

7. The Future of Property Investment

The future of property investment holds promise, with opportunities in emerging markets, sustainable real estate, and innovative investment models. As the world evolves, so too will the landscape of property investment.

Conclusion: Building Wealth, One Property at a Time

Property investment is a powerful wealth-building tool that has stood the test of time. It offers the potential for both financial security and growth. Whether you’re a seasoned investor or considering your first property investment, the world of real estate investment is a dynamic arena where careful planning and strategic decisions can lead to prosperity.